by Anne Hedges and Shannon James

NorthWestern Energy is once again putting corporate profits ahead of Montana customers. Years ago, NorthWestern cut a deal with Puget Sound Energy to acquire Puget’s share of the Colstrip plant when Puget is no longer allowed to sell coal-based electricity to its customers in Washington State. NorthWestern’s existing customers in Montana have no need for more electricity, especially since NorthWestern went on a spending spree and built the Yellowstone County Generating Station. So the question has lingered for years: what is NorthWestern going to do with all of the excess power it will acquire from Puget and Avista Energy?

NorthWestern Energy is once again putting corporate profits ahead of Montana customers. Years ago, NorthWestern cut a deal with Puget Sound Energy to acquire Puget’s share of the Colstrip plant when Puget is no longer allowed to sell coal-based electricity to its customers in Washington State. NorthWestern’s existing customers in Montana have no need for more electricity, especially since NorthWestern went on a spending spree and built the Yellowstone County Generating Station. So the question has lingered for years: what is NorthWestern going to do with all of the excess power it will acquire from Puget and Avista Energy?

Recently, NorthWestern quietly filed a docket at the Federal Energy Regulatory Commission (FERC) requesting permission to create a new corporation within the utility that would not be subject to regulation by the Montana Public Service Commission (PSC). This new, unregulated subsidiary — NorthWestern Colstrip 370 Pu LLC (NorthWestern Colstrip) — will sell the newly-acquired 370 megawatts of electricity from the Colstrip coal plant into the market. Without PSC oversight, NorthWestern’s new corporation will be less transparent and could be shielded from public scrutiny and accountability.

NorthWestern plans to have NorthWestern Colstrip sell the electricity to Mercuria Energy Group, a Houston-based trading firm with no ties to our state. Mercuria will then sell this power on the open market for profit, while NorthWestern’s Montana customers may well end up footing an unfair share of the costs to keep the outdated Colstrip plant running.

Thanks to Earthjustice, MEIC was able to quickly intervene in the FERC proceeding to object to this complex transaction and ensure existing customers are insulated from NorthWestern’s shenanigans.

At least three components of this FERC filing raise questions. First, NorthWestern said that the “energy rates… are below NorthWestern Colstrip’s costs of producing energy.” Translation: NorthWestern’s subsidiary is selling below-cost electricity into the market, leaving Montanans to pay more for their electricity from the Colstrip plant than those who will buy Colstrip power from the market, with no PSC oversight for this new share to ensure Montanans are not subsidizing the cost to operate and maintain the new share of the plant and the transmission system.

Second, in its FERC filing, NorthWestern said its rates for the new power will be based on a previous lower-cost coal contract. Coal is one of the most expensive components of the cost of Colstrip power. If the subsidiary is paying for coal costs based on a previous lower-cost contract for coal from the mine, why should existing customers pay the new higher costs for coal to fuel the same plant?

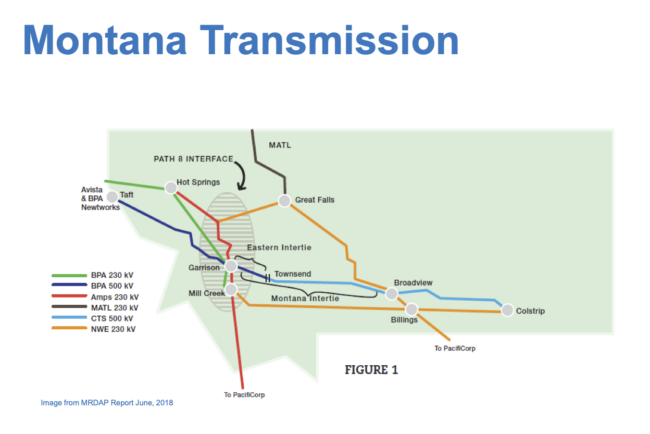

Third, while both Avista Energy and Puget are giving away their shares of the Colstrip plant for economic and legal reasons, they are both maintaining their ownership of the transmission system that moves power from Colstrip to western Montana and other western states. For years, NorthWestern argued that the transmission system is maxed out, yet this deal would result in NorthWestern taking up precious transmission capacity to serve new market loads. This raises concerns that existing customers may be required to sacrifice their access to an already-constrained transmission system. This could impair affordability and reliability, and it could result in customers subsidizing the transmission costs for NorthWestern Colstrip’s sales of electricity into the market.

Montanans are already overpaying for electricity based upon the cost of the Colstrip plant compared to other electricity sources. As a result, Montanans are struggling to pay electricity bills that are 39% higher than they were in 2022. Montanans deserve the ability to guarantee that they aren’t subsidizing the costs of an expensive old coal plant and limited transmission capacity so that NorthWestern’s executives and shareholders can make more money at our expense.

This article was published in the December 2025 issue of Down To Earth.