by Nick Fitzmaurice

In July 2024, NorthWestern Energy filed a rate increase application with the Public Service Commission (PSC). The original filing asked for a 26% increase to residential electricity base rates. This increase included over $2.3 billion in lifetime costs for its Yellowstone County Generating Station (sometimes called the Laurel Generating Station), an outrageous 10.8% return on equity (ROE), and a blank check for investments into the dirty and unreliable Colstrip coal plant that could well exceed $2 billion. This was after the PSC approved a 28% electric rate increase to residential customers in October 2023.

MEIC intervened in the rate case to contest NorthWestern’s proposed increases, with six experts providing testimony and evidence to establish our arguments. The PSC’s hearing was set to begin April 22, but NorthWestern and several other parties filed a partial settlement proposal three weeks after the deadline for filing settlements. The hearing had to be rescheduled for June 9 through June 20 (though it may end sooner). There will be an opportunity for public comment in person and virtually at 9 am the first day of the hearing, and 8 am each day thereafter.

What Was NorthWestern’s Partial Settlement?

A settlement in a rate case is an agreement between certain parties. It does not mean that the PSC has to agree to its terms. In fact, if the PSC does not agree to the provisions of a settlement, then it is void. Although the parties to the proposed settlement agree to no longer contest settled issues at the hearing, the PSC is the final arbitrator for all issues in a rate case, whether or not they are addressed in a proposed settlement. This makes the participation of interveners such as MEIC all the more important because our attorneys can cross-examine NorthWestern’s witnesses on issues for which the settling parties have agreed to be silent.

A handful of interveners – the Montana Consumer Counsel (MCC), the Large Customer Group, Walmart, and the Federal Executive Agencies – signed onto the partial settlement proposal. MEIC and several other parties did not. While the proposed settlement reduces NorthWestern’s requested rate increase, the utility is still asking for a 20.2% increase to residential electric base rates. The decrease from the original filing is largely attributable to an agreement to lower NorthWestern’s requested ROE from 10.8% to 9.65%, the same ROE the PSC previously approved for most of NorthWestern’s generation assets. NorthWestern also agreed to withdraw its request for a blank check for Colstrip plant investments, but only after Pres. Donald Trump issued an Executive Order allowing the plant to postpone compliance with public health protections (see article on pg. 8). NorthWestern is still requesting to charge customers $11.6 million for recent investments in the Colstrip plant.

This is considered a “partial” settlement proposal because the settling parties did not agree on two very important issues, which will need to be resolved by the PSC. First, the settling parties did not agree on how much NorthWestern can charge customers for its new gas plant near Laurel. Second, they didn’t agree on certain costs that can be automatically charged to customers, often referred to as “pass-through” costs. For example, if MCC gets its way on those non-settled issues, the increase to residential customer base rates would be 16.0% rather than NorthWestern’s desired 20.2%. If NorthWestern gets its way, the average residential customer will be on the hook for as much as $128.77 annually just to pay for the gas plant. Although the final costs to customers remain to be adjudicated, the partial settlement, combined with NorthWestern’s stance on unsettled issues, would unfairly burden residential customers. While the residential customer class makes up 47% of NorthWestern’s current base revenue requirement, NorthWestern proposes to allocate a disproportionate 54% of the base revenue increase to residential customers.

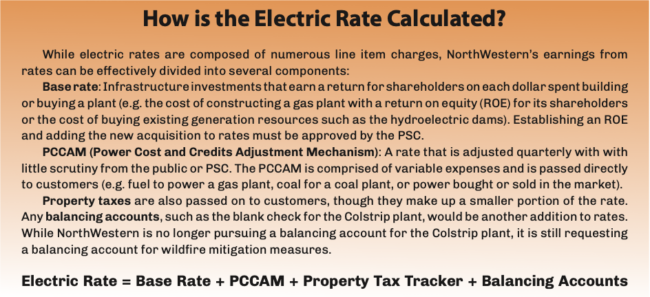

NorthWestern uses a sleight of hand to argue that the proposed settlement, combined with its stance on unsettled issues, would result in a net 4.2% increase to residential electric rates. NorthWestern is assuming that pass-through costs known as Power Costs and Credits Adjustment Mechanism (PCCAM) will be dramatically reduced by selling nearly six times more excess power into the export market than it has in the past (from $33.6 million to $190.3 million), mitigating the overall rate increase. This is based on mere hopes that the Laurel gas plant — the most expensive resource to operate in the utility’s portfolio — will be cost-competitive with other regional resources. There is a very real risk that NorthWestern’s overly optimistic projections do not materialize, leaving customers on the hook for the extraordinary costs from building the plant without any offsetting benefits from market sales.

If NorthWestern fails to sell all that power into the market, it can adjust the PCCAM each quarter and charge customers for 90% of under-collected expenses. In other words, if it does not sell enough power to offset the cost of the base rates, then its purported 4.2% increase to residential bills could quietly balloon to the full 20.2% base rate increase. And that is exactly what appears likely to happen based on the actual amount of power NorthWestern has sold into the market since it filed its application in July. MEIC and other parties in the rate case asked NorthWestern to verify its actual market sales for the months since the original rate case filing to truth-test its sales estimate. In the first four months of the Laurel gas plant’s operations, market sales were already $70.1 million below what NorthWestern had projected. NorthWestern should not be able to claim rates will only rise 4.2% because of its fictitious estimate of market sales, when in fact rates will likely rise by as much as 20%.

MEIC’s attorneys at Earthjustice will be raising these issues and more during the rate case hearing. With any luck, the PSC will protect residential and small business ratepayers from another sharp rate increase proposed by a monopoly utility that is more concerned about its shareholders than its customers.

This article was published in the June 2025 issue of Down To Earth.