by Anne Hedges (2/3/20)

Education is powerful. That’s why we want you to know about NorthWestern Energy’s attempt to confuse ratepayers with its phony “No B.S.” climate change plan.

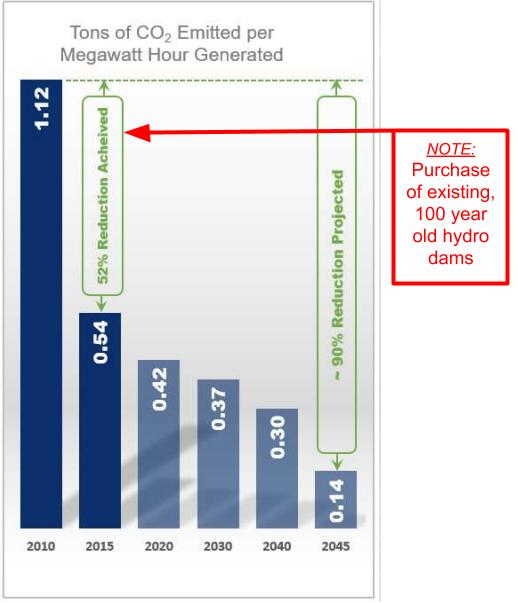

In December 2019, NorthWestern claimed it would reduce its “carbon intensity” by 90% by 2050. Sounds good, right? Think again. NorthWestern claims to have already reduced its carbon intensity by over 50% since 2010. However, during that same time period it continued to own the same amount of the Colstrip coal-fired power plant AND it added a gas plant as a greenhouse gas emissions source.

So how can the company make this claim? The key to deciphering this bogus statement lies in defining the term “carbon intensity,” which is not the same as “carbon reduction.” NorthWestern is using the term “carbon intensity” as if that means it will actually reduce real world greenhouse gas emissions, such as carbon dioxide. But “carbon intensity” is a ploy to confuse people while the company avoids actually reducing emissions.

Examining NorthWestern’s claim of a 50% reduction in carbon since 2010 tells the real story. During that period NorthWestern didn’t close any coal or gas plants. In fact, it built a new gas plant near Anaconda. Instead of counting actual tons of greenhouse gas emissions it released each year, NorthWestern used its 2014 purchase of the hydroelectric dams to water down on paper the percentage of its carbon dioxide emissions compared to its overall generation capability. Keep in mind, many of those dams have been around 100 years or more. Just because NorthWestern now owned them on paper did not mean any actual, real-world carbon emission reductions had occurred. But through this paper shuffling exercise, the “carbon intensity” of the company’s overall generation portfolio decreased despite its actual increase in greenhouse gas emission sources.

In other words, NorthWestern is trying to mislead people into thinking emissions have gone down since 2010 when, actually, their ownership of plants that emit greenhouse gases increased. Facts are stubborn things.

Red box is a commentary note of MEIC. Graph from presentation given by NorthWestern to Wells Fargo Securities Midstream and Utility Symposium, December 12, 2019, page 29.

Compare this to the January 22nd announcement by the largest utility in Arizona – not a state known for its strong stand on climate. That utility, Arizona Public Service (APS), announced it would get off of coal by 2031 and eliminate all carbon emissions by 2050. When APS said no coal and no carbon emissions, it meant just that. Compare that to NorthWestern’s deceptive climate change plan that uses “carbon intensity” as the measure of success instead of actual carbon dioxide reductions – which would allow it to increase emissions of climate changing pollution – while deceptively calling it a reduction.

Climate change won’t be solved by corporate double-speak, like “carbon intensity.” Actual emission reductions, such as those committed to by APS, are all that matter. NorthWestern obviously understands it needs to say it is doing something on climate change, which makes this political PR stunt even more shameful. An honest carbon reduction plan does not include increasing emissions through buying more shares of a dirty old coal plant, no matter how NorthWestern tries to spin it.

The financial sector understands this even if NorthWestern does not. BlackRock, the world’s largest asset manager, and apparently NorthWestern’s largest investors, just cited its fiduciary obligation to its investors when it announced a new policy to address the very real financial risk posed by climate change. In a letter to the investors, the C.E.O. said, “climate risk is investment risk.” The BlackRock CEO wrote:

“Thermal coal is significantly carbon intensive, becoming less and less economically viable, and highly exposed to regulation because of its environmental impacts. With the acceleration of the global energy transition, we do not believe that the long-term economic or investment rationale justifies continued investment in this sector.”

NorthWestern should heed the advice of the world’s largest financial institutions, such as BlackRock. Its customers and the climate depend on it.