by Nick Fitzmaurice

NorthWestern Energy’s rate case at the Montana Public Service Commission won’t be decided until after the April 2025 hearing, but MEIC is already working on it full tilt. Central to NorthWestern’s requested 26% increase to base electricity rates are its requests to 1) recover costs for the Yellowstone County Generating Station (YCGS) methane gas plant and 2) recover a blank check for future, life-extending investments at the Colstrip power plant (more details in the October 2024 issue of Down to Earth).

In October, MEIC and a number of partners and supporters voiced concerns about this rate case to the Montana Consumer Counsel (MCC). Montana’s Constitution establishes the MCC to advocate for the captive customers of Montana’s regulated monopoly utilities. Unfortunately, MCC signed onto the settlement agreement in NorthWestern’s last rate case, passing a 28% electric rate increase to residential customers. The Counsel’s legislative oversight committee will meet again in December, and MEIC will again advocate for the MCC to protect Montana consumers from NorthWestern’s excessive request.

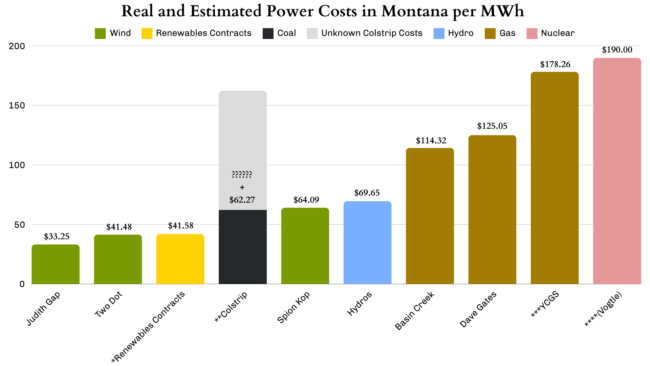

While NorthWestern continues driving up rates, the utility neglects to invest further in the most affordable energy sources available: wind and solar. NorthWestern’s most recent clean energy investments — the small 40-megawatt (MW) Spion Kop and even smaller 11-MW Two Dot wind facilities — were built in 2012 and 2014, respectively (Two Dot sold power to NorthWestern until NorthWestern purchased it in 2018). The utility’s 20-year contract for power from the much larger (135 MW) and highly cost-effective Judith Gap wind farm expires in 2026, and NorthWestern has indicated it will not include this power in its portfolio past that date. All other wind projects in NorthWestern’s portfolio — in addition to all its solar resources — result from federally required contracts. Despite NorthWestern’s claims, it has fought to keep these undeniably affordable renewables out of its portfolio. Montana’s hydroelectric dams have provided carbon-free electricity for more than 100 years, but NorthWestern did not build these and should not be allowed to use them as an excuse to avoid future investments in affordable carbon-free energy.

Even more insidious is NorthWestern’s apparent strategy to replace existing, affordable renewables contracts with expensive fossil fuel plants that drive up corporate profits at the expense of customers. In its 20-year plan, NorthWestern projects that the expiration of its renewable energy contracts will result in future demand for more electricity generation. This need for more power helps NorthWestern justify expensive fossil fuel investments, such as YCGS and increased ownership in the Colstrip plant. However, when its renewables contracts eventually expire, NorthWestern turns around and uses its additional fossil fuel generation as justification for not needing to negotiate an extension of those affordable renewable energy contracts. If NorthWestern were to proactively negotiate its contracts with renewable energy projects and plan for that energy in its portfolio, there would not be a need for additional fossil fuel investments in the first place.

NorthWestern claims that 60% of its electricity is carbon-free, but the additions of YCGS and additional ownership at the Colstrip plant could reduce that carbon-free ratio to as low as 22%. As NorthWestern’s various renewable energy contracts expire, this will only decrease further. Instead of investing in an affordable, clean energy future, NorthWestern’s investments into the YCGS methane plant and the Colstrip plant seek to maximize profits at the expense of bill-paying customers and the planet. MEIC will not stand for this foul play.

NorthWestern’s portfolio, but the utility shows no interest in increasing these resources in its portfolio. This chart outlines cost per unit of energy (MWh) for NorthWestern’s different generation sources (with a nuclear comparison). The utility shared its data with the Montana Public Service Commission (PSC) in 2023 and 2024. The nuclear power cost estimate is pulled from financial analyst firm Lazard’s annual Levelized Cost of Energy report.

*Required Qualifying Facility contracts under the federal Public Utility Regulatory Policies Act (PURPA). These plants are developed and run by independent energy developers, contracting power to NorthWestern Energy. NorthWestern recently reported 11 wind plants, 14 hydroelectric plants, and nine solar plants within this category as well as two small fossil fuel plants. The two fossil fuel plants dramatically increase the average cost per MWh from contracted facilities.

**Not included in Colstrip’s cost per MWh of power are compliance costs for long-overdue pollution upgrades, increasing fuel costs under a new contract with the mine, and remediation costs. NorthWestern has unjustifiably kept these costs separate, possibly to artificially reduce the plant’s costs in the short term.

***Yellowstone County Generating Station costs are based on NorthWestern Energy data in the rate case.

****There is no nuclear power in Montana. The only nuclear plant built in the U.S. in nearly 30 years is Georgia’s Vogtle plant. Vogtle cost nearly $37 billion after an initial $14 billion estimate and was nearly a decade overdue, making it the most expensive power plant ever built.

This article was published in the December 2024 issue of Down To Earth.