By Ian Lund

Ian Lund traveled to several cities in Montana to discuss the IRP with community members. MEIC will also host a virtual meeting about the IRP in January.

Every three years, Montana’s largest utilities must present a document to the Public Service Commission (PSC) that describes how its energy requirements are expected to change over the next 20 years and its best approximation of the most efficient way to meet those needs. This document is called an Integrated Resource Plan (IRP). Every utility in the country does some version of this forecasting and planning, though with different requirements, inputs, and outputs, depending on the policies and laws in different jurisdictions. The primary question utilities ask is: Do we have enough electricity resources to keep the lights on every day, in every situation, and if not, what are the best and most cost-effective interventions that the company can invest in to ensure a reliable grid?

Although the purpose of this process is to identify the most cost-effective means of keeping the lights on, this particular IRP originates from a profit-seeking company who is primarily accountable to its shareholders. NorthWestern Energy’s planning more often benefits its own bottom line than the average electricity customer in Montana. MEIC has engaged in IRP development and evaluation for all recent resource planning cycles to identify deficiencies in the plans and ensure those deficiencies are addressed.

NorthWestern’s 2022 IRP is chock-full of deficiencies and misrepresentations. These are not accidents. Like it always does when writing its IRPs, NorthWestern manipulated the model such that it recommended resources that would be most profitable for NorthWestern to build. The top three most concerning aspects are addressed here.

Ignoring the Inflation Reduction Act

NorthWestern’s model does not have the company building large renewable energy projects in any scenario except one – if Colstrip retires in 2035. Even then, it doesn’t begin building until 2040. The cost of renewable energy and storage technologies is steadily declining and became even cheaper when Congress passed the Inflation Reduction Act (IRA) in August 2022. So why aren’t renewable energy and storage projects showing up in NorthWestern’s resource procurement model? NorthWestern does not explain its model inputs in its draft IRP, but it’s clear that NorthWestern refuses to consider the IRA’s impact on the price of carbon-free generation technologies. Not including these cost reductions artificially inflates the cost of the most competitive carbon-free resources. By ignoring the IRA, NorthWestern will wait three years until the next planning process to account for cost reductions that are available now, leaving the PSC and utility to rely on outdated and incorrect price information in the meantime.

Underestimating the cost of gas plants

NorthWestern’s 2019 IRP recommended that the company build gas plants every year for five years starting in 2022. Fast forward to the present, and NorthWestern is asking the PSC for permission to charge ratepayers $280 million plus a hefty rate of return for just one methane gas plant.

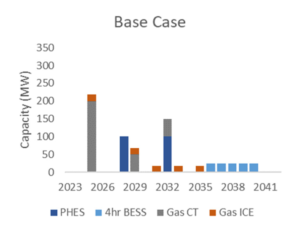

True to form, the model used to select resources in NorthWestern’s latest IRP almost invariably chooses to build a 200 MW methane gas plant in 2025, with more gas plants to follow. In the same way NorthWestern manipulates its IRP to overestimate the cost of renewable energy, it underestimates the cost of gas plants. For starters, it omits the cost of the gas pipeline infrastructure from the total cost of the plant. When NorthWestern builds new gas plants, it needs to build new pipelines, as demonstrated at the Yellowstone County Generating Station.

The capital cost of pipelines solely serving a gas plant are ultimately passed along to ratepayers and is a cost unique to that technology. NorthWestern alludes to a reason for omitting pipeline costs in its IRP on page 53, stating: “Indirect costs such as pipeline upgrades or transmission requirements were not included.” But this draws a false equivalency between pipeline costs and electric interconnection, distribution, and transmission costs. Gas plants, hybrid renewable systems, and nuclear plants all require interconnection work and distribution-side costs, but only gas plants require the specific supply input of a pipeline. Therefore, omission of pipeline costs artificially deflates the cost of gas combustion resources relative to other resources.

NorthWestern Energy’s “Base Case” model primarily recommends adding methane gas resources (gray) and pumped hydro (blue), without any renewables, over the next 20 years.

No assessment of non-supply resources

The cheapest energy resource is the energy that we don’t use, whether through strategic conservation or efficiency upgrades. Large utilities such as NorthWestern are uniquely positioned to deploy these “demand-side resources” (so-called because they are non-generation interventions deployed at homes and businesses where people consume energy, rather than utility-owned power plants) because of their knowledge of each customers’ energy consumption and their ability to communicate with them.

In addition to helping people save energy at home, investing in helping people use less energy defers or eliminates the need to build expensive new power plants and can provide a flexible way to adapt energy consumption to a highly renewable grid. It would take time to develop such programs, but the whole point of the planning exercise is to take the long view over a 20-year period. NorthWestern includes its existing demand-side management programs in its IRP, but does not envision growing it more than by a minuscule percentage over the planning period. Taken seriously, demand-side resources can compete with gas plants and decrease customers’ electric bills.

These are only a few of the glaring manipulations NorthWestern employs in its draft IRP. For a full account of MEIC’s concerns with the IRP and to learn how it can be improved, attend one of our upcoming events or sign up for our action alerts email list at www.meic.org/take-action. The PSC will be holding a hearing on the IRP in early 2023 at which the public can voice its concerns and request that NorthWestern Energy go back to the drawing board to give us a realistic picture of Montana’s energy future.

This article was published in the Dec. 2022 issue of Down To Earth.