NorthWestern Energy’s 2024/25 Rate Case

NorthWestern Energy Wants to Raise Your Rates… AGAIN

See Recent Updates, MEIC’s Updated Rate Case Factsheet, and MEIC’s Rate Case Final Order Analysis for more information.

Webinars:

- October 2024: MEIC’s overview of the rate case (watch now)

- April 2025: Ask the Experts webinar (watch now)

At a Glance:

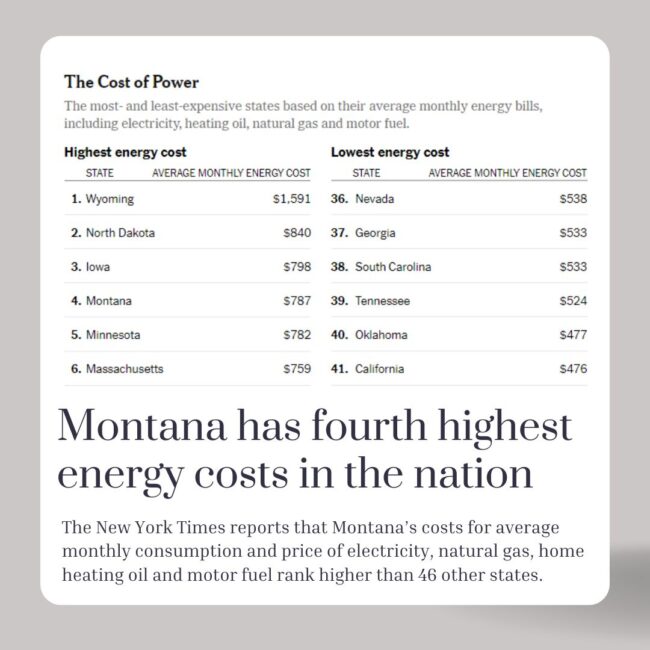

- NorthWestern Energy is requesting a 26% increase to base electricity rates after electricity rates were raised by 28% in the fall of 2023. Montanans already have some of the highest electricity rates in the region and the fourth-highest energy costs in the country.

- NorthWestern wants to charge customers more than $2.3 billion in lifetime costs for the Yellowstone County Generating Station methane gas plant near Laurel.

- NorthWestern wants a blank check to charge customers for undisclosed future investments in the Colstrip coal-fired plant which could well exceed $2 billion. This blank check would likely increase to reflect NorthWestern’s increased ownership if the utility successfully acquires additional shares of the nation’s dirtiest coal plant.

- The Colstrip plant is old and unreliable, operational only half the time we need it, such as during the January 2024 cold snap and the July heat wave.

- The utility makes a fixed rate of return on capital investments, meaning NorthWestern would make a huge profit on the excessively expensive YCGS gas plant if allowed by the PSC, just like it earns on the Colstrip plant. While customers foot the bill, NorthWestern is disincentivized to invest in more affordable forms of energy such as wind, solar, and storage.

- Download this fact sheet as a PDF.

Who Makes Decisions About Energy Rates in Montana?

- The elected commissioners that serve on the Montana Public Service Commission (PSC) are responsible for regulating public utilities like NorthWestern Energy and must balance utilities’ needs with customer needs.

- The legislatively-appointed Montana Consumer Counsel (MCC) is responsible for advocating before the Montana Public Service Commission and in select matters under the jurisdiction of federal agencies and state and federal courts, representing the interests of consumers of regulated utilities.

- Montana state legislators write and pass bills that can impact how the PSC and MCC operate and that dictate the regulatory landscape for public utilities like NorthWestern Energy.

**************************************************

Diving Deeper

NorthWestern Energy has returned to the Montana Public Service Commission (PSC) asking for permission to reach into customers’ pockets for another rate increase to prop up its budget-busting and heavily polluting fossil fuel investments. Unfortunately, these increases have resulted in Montana having among the highest electricity rates in the region (and fourth highest energy costs in the country), and still climbing if NorthWestern has its way.

NorthWestern Energy is allowed to operate as a monopoly utility in Montana to streamline energy infrastructure in the state. Rather than having 10 competing utilities run power lines down your street, the idea is that this infrastructure is consolidated under one monopoly entity. In exchange, Montanans elect five Public Service Commissioners who are supposed to regulate the monopoly and prevent exploitative practices. Unfortunately, NorthWestern Energy and the PSC have demonstrated a lack of accountability time and time again.

As a regulated utility, NorthWestern must submit an application to the PSC whenever the utility wants to raise customers’ rates. This application kicks off a rate case, a months-long PSC review in which anyone can petition to formally intervene, contributing to the case’s record to advocate for various interests. NorthWestern’s last rate case included interveners representing environmental interests, state and federal government agencies, industry groups, energy developers, and specific companies. This information-gathering process typically includes informal opportunities for public participation through a public hearing and comment period.

This page will be updated as more information about this rate case becomes available. Use these links to jump to a section.

- Recent Updates

- Yellowstone County Generating Station and Skyrocketing Electric Rates.

- The Volatile Cost of Methane Gas.

- A Blank Check for “Colstrip Compliance”?

- The Colstrip Plant is NOT Reliable.

- What About Clean and Affordable Wind and Solar Energy?

- There’s Also an Interim Rate Increase.

**************************************************

Recent Updates:

- On December 24, 2025, the PSC issued its final order. Intervening parties have an opportunity to request the PSC reconsider this final order through January 16. Read MEIC’s analysis of the final order.

- On November 18 and 19, 2025, the PSC discussed recommendations from its staff for making a final determination in the rate case. The PSC then voted to extend by 30 days its November 24 deadline to issue a final order which is now expected by December 24.

- On July 1, 2025, NorthWestern implemented its quarterly PCCAM adjustment to account for its under-collection of variable costs due to its artificially low variable rate projections. This increased rates even further from the May 23 interim adjustment.

- On June 18, 2025 NorthWestern Energy’s hearing before the Public Service Commission (PSC) concluded. What remains is post-hearing briefs from NorthWestern and intervening parties will be complete at the end of August. Then the PSC will issue a final decision sometime this fall. Here is an overview of our arguments to the Commission.

- On May 23, 2025, NorthWestern began self-implementing its rate increase on an interim basis based on a statutory nuance that allowed them to do so once nine months had elapsed from its application. This is subject to refund with interest to ratepayers should the PSC’s final determination in the rate case be less than these interim rates.

- On April 23, 2025 the PSC issued an updated procedural order in the rate case, setting the new hearing dates to June 9 through June 20. Read MEIC’s Updated Rate Case Factsheet for a rundown on where various issues stand heading into the hearing.

- On April 14, 2025, NorthWestern filed a late settlement agreement in the rate case with the Montana Consumer Counsel, the Large Customer Group, Walmart, and the Federal Executive Agencies. This would be a partial settlement, and cost recovery for the YCGS methane plant and the PCCAM pass-through costs are still fully contested. As part of the settlement, NorthWestern has withdrawn the request for the Reliability Compliance Balancing Account for the Colstrip plant, though NorthWestern recently received a federal waiver to avoid complying with important EPA standards that would protect Montanans’ health. Non-settling parties – including MEIC – still have the opportunity to contest all issues in this rate case and the PSC is the final arbiter on all issues. With this last-minute settlement, the PSC cancelled the hearing that was set to begin on April 22, 2025.

- On Jan. 3, 2025 the PSC voted to deny NorthWestern Energy’s motion for reconsideration of its interim rate increase request. This maintains the Commission decision from Nov. 26.

- On Nov. 26, 2024, the Public Service Commission voted to protect ratepayers by rejecting a $58 million attempted money grab for NorthWestern Energy which would have allowed unjustified rate recovery associated with the supposed “market benefits” of the Yellowstone County Generating Station (YCGS) methane gas plant: “The Commission finds that the proposed bridge rate does not reflect YCGS’s actual costs and would result in a significant over-charge to customers.” While this is a small win and NorthWestern’s larger rate case is ongoing, it is worth celebrating. As a result, beginning December 1, 2024, electric rates will decrease by 7.24% (about $8 per month).

- In an update filed in September, NorthWestern indicated that the Yellowstone County Generating Station is expected to come online on October 18, 2024. The utility has now requested that the PSC approve its interim rate increase request to go into effect on November 1.

- On September 18th, 2024, the PSC filed its tentative schedule for the rate case. A public hearing is set to take place in Helena and remotely beginning Tuesday, April 22nd, 2025, continuing day-to-day as needed.

- On August 23, 2024 NorthWestern submitted a second supplemental filing in response to the PSC’s request. Upon reviewing this filing, the PCS determined NorthWestern’s application to be complete, kicking off official PSC review of the application.

- On August 20, 2024, the PSC rejected NorthWestern’s application again as still insufficient, requesting further information from the utility. The PSC indicated that NorthWestern’s supplemental materials addressed all but one deficiency that had been identified in the utility’s application.

- On August 6, 2024, the PSC rejected NorthWestern Energy’s original application as insufficient, requesting more information from the utility before the PSC will begin its review. NorthWestern submitted supplemental materials in response to the PSC’s request on August 9.

Click here to go back to the top.

**************************************************

Yellowstone County Generating Station and Skyrocketing Electric Rates.

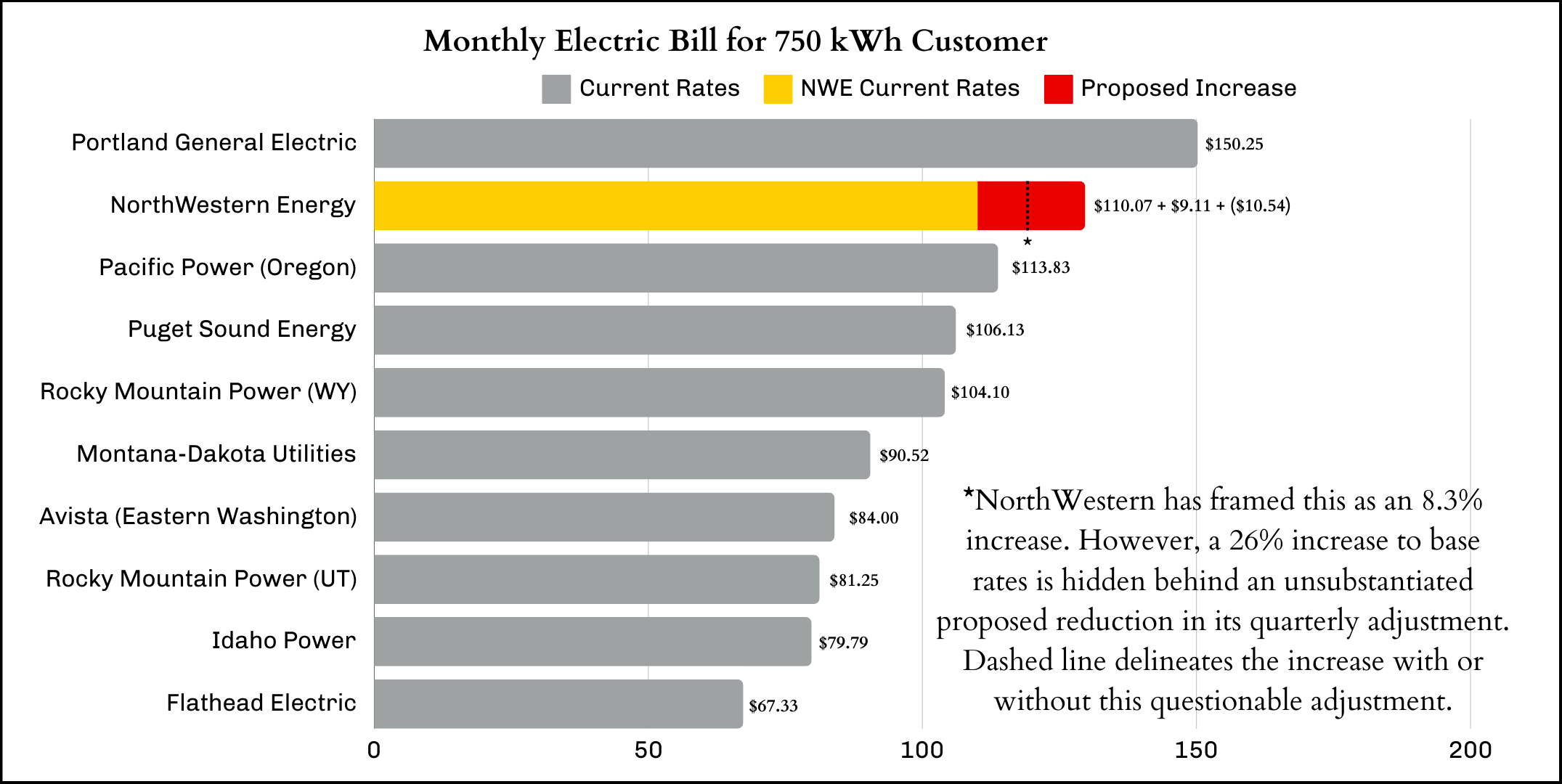

NorthWestern Energy will have the second highest electric rates in the region if its requested increase is approved. Before other utilities had rate increases of their own, NorthWestern’s previous rate case gave the utility the highest rates in the region in 2023.

Last fall, the PSC approved a 28% electric rate increase for NorthWestern’s residential and small business customers, and now the utility is requesting an additional 8.3% increase. Together, that compounds to a 39% increase in residential customers’ electric bills in front of the PSC within a year. However, NorthWestern is not telling the whole story because the fine print of its application reveals an underlying 26% increase to fixed base electric rates, offset by reduced variable rates that are frequently adjusted up and down.

The Yellowstone County Generating Station (YCGS) methane gas plant near Laurel is driving this requested increase. While the plant’s construction alone cost NorthWestern upwards of $320 million, previous estimates show that ratepayers may be on the hook for over $2.3 billion dollars. NorthWestern is hiding the true cost of the plant, claiming it will save customers $58 million in annual electricity purchases from the market. Even if that were true – and there is no evidence to suggest it is – those savings would not pay for the plant.

Meanwhile, there is no penalty if NorthWestern’s market purchase forecasts are wrong. Montanans can’t afford to pay $2.3 billion for a plant that may save us $58 million a year. If shareholders want to take on that risk, so be it. But financially-strapped Montana families should not be on the hook for a bad investment.

Unpacking NorthWestern’s requested rate increase causes even more concern. While electric rates are composed of numerous line item charges, NorthWestern’s earnings from rates can be effectively divided into two components:

- A base rate from fixed infrastructure investments that earn a hefty return for shareholders on each dollar spent building or buying a plant (e.g. constructing a gas plant at NorthWestern’s requested 10.8% return on equity for its shareholders or buying a coal plant at a 10.3% return for shareholders), and

- A rate that is adjusted quarterly to cover variable expenses and is passed directly to customers (e.g. fuel to power a gas plant, coal for a coal plant, or power bought or sold between utilities in the region). This is called the Power Cost and Credits Adjustment Mechanism (PCCAM).

These components are addressed separately at the PSC, but NorthWestern has combined them in its application, obscuring the true extent of the increase. In reality, NorthWestern is requesting permission to increase the base electricity rate by a whopping 26% in this rate case! It appears that the utility may have fabricated the 8.3% number by artificially reducing its PCCAM rate by 43% – in other words, NorthWestern is saying that the next quarter’s PCCAM rate will be 43% lower than the previous quarterly PCCAM rate.

NorthWestern’s explanation for this decrease is incomplete and somewhat misleading, asserting that the YCGS gas plant will reduce its need to purchase electricity from the market. However, close review of the application reveals that the utility anticipates nearly doubling market purchases (rather than reducing them), with these purchases offset by an unprecedented (nearly sixfold) increase in market sales. NorthWestern is showing it will have a net reduction in PCCAM costs by selling nearly six times more energy into the regional market, an unprecedented increase that the utility does not justify in its filing. It’s unclear if the outdated and constrained transmission system could even move that much electricity annually. This is how NorthWestern hides its 26% base rate increase within an 8.3% overall increase. Of course, there is no penalty if NorthWestern fails to sell that much power into the market, in which case rates would skyrocket even more in a future quarterly PCCAM filing when customers finally face the full 26% base rate increase. What NorthWestern lacks in providing details, it makes up for by hiding the ball and jacking up electricity rates.

Click here to go back to the top.

**************************************************

The Volatile Cost of Methane Gas.

Photo by Carah Ronan.

Unfortunately, NorthWestern’s greed doesn’t stop there. Having received PSC approval this July for a 33% rate increase to all gas customers, NorthWestern’s current request includes an additional 17% residential gas rate increase. That compounds to a 56% total increase in the same month! Compounded with last year’s 13% increase, that’s a 76% increase in front of the PSC within a year. While the costs of expensive gas used to fuel the YCGS plant are technically factored into electricity rates, using more gas to fuel this plant could further strain an already volatile gas market. Luckily for NorthWestern, and unluckily for the rest of us, fuel costs are passed directly to its customers in our bills.

Click here to go back to the top.

**************************************************

A Blank Check for “Colstrip Compliance”?

The Colstrip power plant and ash ponds, photographed in 2019. Credit: Alexis Bonogofsky / MTFP

Buried within NorthWestern’s application is the request to create a “Reliability Compliance Balancing Account” for future “compliance costs necessary to continue to operate Colstrip.” In other words, NorthWestern is asking for money to comply with growing regulations so it can keep the Colstrip plant open as long as possible. The utility provides no details on how much money it will collect from customers, what it will buy with that money, or whether there are less expensive alternatives. The utility certainly doesn’t mention that it intends to quadruple its ownership share of the plant, which will quadruple the amount it will charge customers for these undisclosed “compliance costs.” This request asks for nothing less than a blank check from the PSC, charging customers an undisclosed fee on a per kilowatt-hour basis for any and all expenses incurred to bring the country’s dirtiest coal plant in compliance with national pollution standards.

NorthWestern conveniently left out that these compliance costs will likely exceed $2 billion – that’s billion with a “b” – while some have estimated that this number could even exceed $3 billion. In 2018, the U.S. Department of Energy analyzed the cost of installing carbon capture and storage (CCS) at the Colstrip Power Plant and determined that it would cost over $1.3 billion to reduce only 63% of the CO2 emissions, decreasing the plant’s energy output in the process. Operating that carbon capture technology would cost an additional $108 million annually. In addition, if the Colstrip plant owners are to be believed, they have said that installing industry-standard pollution controls for toxic air pollution could cost customers in excess of $600 million. Every similar coal plant in the nation has already installed this technology. That’s why the Colstrip plant has the highest toxic emissions rate of any of the 237 coal units EPA analyzed. So, while NorthWestern seeks to nearly quadruple its ownership in the plant as the self-proclaimed only utility in the US investing in more coal energy, it is asking for a blank check to pay for the upgrades, on top of the 26% increase, without considering the far less expensive alternatives to generate electricity.

Click here to go back to the top.

**************************************************

The Colstrip Plant is NOT Reliable.

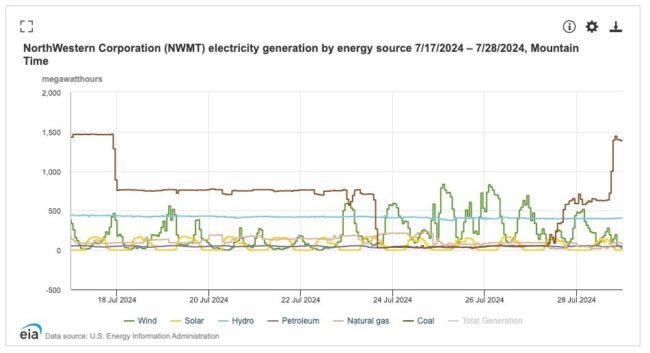

Both units at the Colstrip plant were down during the hottest days of the year. One unit went down on July 18, and the other unit went down on July 23 — one of the hottest days in global recorded history. Data via EIA.

NorthWestern claims it needs an increased share of the Colstrip plant because the plant provides reliable power. Nothing could be further from the truth. NorthWestern doesn’t bother to provide information in its application on why the Colstrip plant is necessary to ensure reliability on the power grid, other than a blind assertion that it is. In fact, the Colstrip plant has experienced frequent outages during some of the coldest and hottest days of 2024, while historic data shows that the plant only provides 51% dependable capacity, far from NorthWestern’s asserted 99%. When customers need power the most, it is a coin toss whether the plant can provide it. That’s not reliable.

Click here to go back to the top.

**************************************************

What About Clean and Affordable Wind and Solar Energy?

NorthWestern Energy operates as a monopoly utility in Montana, with the elected Public Service Commissioners serving as the last line of defense between the utility and Montana ratepayers. Unfortunately, the PSC and the Montana Consumer Counsel (MCC) have bowed to NorthWestern’s requests time and time again, leaving ratepayers defenseless. NorthWestern has now built the YCGS gas plant, the most expensive type of gas plant there is, and is trying to saddle customers with the expensive, unreliable, and decrepit Colstrip plant. Why? Because the utility makes a fixed rate of return on its capital investments, funded by ratepayers. The more money it spends, the more money it rakes in for its shareholders and executives’ multi-million dollar salaries. Without a PSC and MCC that demand protections for customers, it is no wonder that NorthWestern is making no further investments into wind and solar, the cheapest forms of energy available. While other states are stepping in to take advantage of Montana’s second-highest wind energy potential and fourth-highest solar energy potential in the nation, NorthWestern doubles down on the most expensive electricity-generating resources available as reflected directly in our skyrocketing electric bills.

Click here to go back to the top.

**************************************************

There’s Also An Interim Rate Increase.

While most of the rate case process will focus on assessing the full scope of NorthWestern’s requested rate increase, the utility included in its application a request for interim rate increases to go into effect October 1. On November 26, the PSC voted to protect ratepayers by rejecting a $58 million attempted money grab for NorthWestern Energy which would have allowed unjustified rate recovery associated with the supposed “market benefits” of the Yellowstone County Generating Station (YCGS) methane gas plant: “The Commission finds that the proposed bridge rate does not reflect YCGS’s actual costs and would result in a significant over-charge to customers.” While this is a small win and NorthWestern’s larger rate case is ongoing, it is worth celebrating. As a result, beginning December 1, 2024, electric rates will decrease by 7.24% (about $8 per month).

Unfortunately, gas remains a volatile and expensive energy source, and the PSC approved an 8.44% increase for NorthWestern’s methane gas (“natural gas”) customers.

Among numerous parties that have entered as formal intervenors in this rate case, contesting specific pieces of NorthWestern’s request, MEIC was the only intervenor to file an objection to NorthWestern’s outrageous requested interim increase. Specifically, MEIC outlined numerous reasons why the inclusion of a $58 million “bridge rate” for YCGS was excessive and unlawful. While a number of factors were considered in this interim rate adjustment, rejection of that $58 million bridge rate will result in a $7.92 monthly saving for electric customers consuming 750 kWh.