By Nick Fitzmaurice

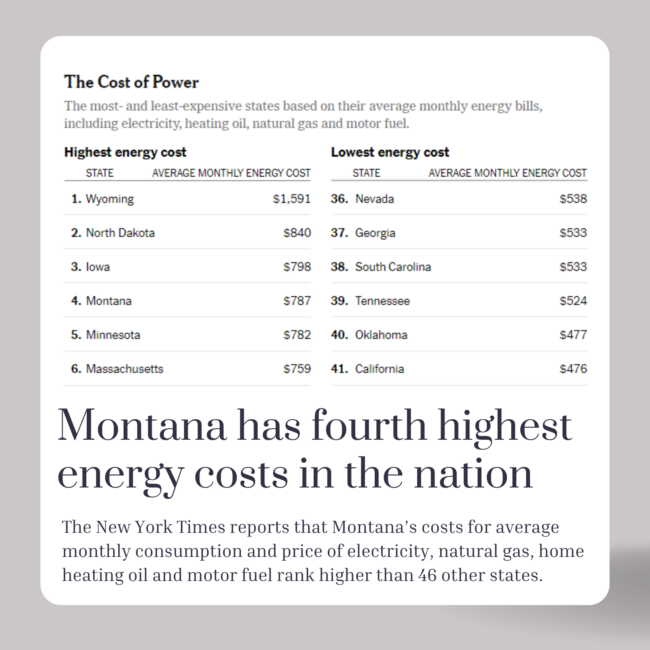

NorthWestern Energy has returned to the Montana Public Service Commission (PSC) asking for permission to reach into customers’ pockets for another significant rate increase to prop up its budget-busting and heavily polluting fossil fuel investments. Unfortunately, these increases have resulted in Montana having the second highest electricity rates in the region (and fourth highest energy costs in the country), and still climbing if NorthWestern has its way.

NorthWestern Energy has returned to the Montana Public Service Commission (PSC) asking for permission to reach into customers’ pockets for another significant rate increase to prop up its budget-busting and heavily polluting fossil fuel investments. Unfortunately, these increases have resulted in Montana having the second highest electricity rates in the region (and fourth highest energy costs in the country), and still climbing if NorthWestern has its way.

Last fall, the PSC approved a 28% electric rate increase for NorthWestern’s residential and small business customers, and now the utility is requesting an additional 26% increase to electric base rates. NorthWestern claims that the rate increase is only 8.3%, but the utility is not telling the whole story because the fine print of its application shows the 8.3% increase is just the tip of the (rapidly melting) iceberg.

Yellowstone County Generating Station and Skyrocketing Electric Rates

Cost recovery for the Yellowstone County Generating Station (YCGS) methane gas plant near Laurel is a major component of this requested increase. While the plant’s construction alone cost NorthWestern upwards of $320 million, previous estimates show that ratepayers may be on the hook for over $2.3 billion over its lifetime when accounting for the utility’s return on investment and property taxes, as well as operating, maintenance, and fuel costs. Financially-strapped Montana families should not be on the hook for this bad investment.

Unpacking NorthWestern’s requested rate increase causes even more concern. While electric rates are composed of numerous line item charges, NorthWestern’s earnings from rates can be effectively divided into two components:

- A base rate for capital investments such as the construction costs for a new $320 million gas plant. This includes the hefty return NorthWestern shareholders earn on each dollar the utility spends, such as the 10.8% return on equity NorthWestern is asking for in the YCGS gas plant.

- A fluctuating rate that is adjusted quarterly to cover variable expenses and is passed directly to customers. These variable costs include fuel costs (methane gas for a gas plant and coal for a coal plant) and power bought or sold between utilities in the region. This is called the Power Cost and Credits Adjustment Mechanism (PCCAM).

These components are usually addressed separately at the PSC, but NorthWestern has combined them in its application, obscuring the true extent of the increase. In reality, NorthWestern is requesting permission to increase the base electricity rate by a whopping 26% in this rate case, hidden behind a seemingly artificially reduced PCCAM rate.

NorthWestern’s explanation for this decrease is incomplete and somewhat misleading, asserting that the YCGS gas plant will reduce its need to purchase electricity from the market. However, close review of the application reveals that the utility anticipates nearly doubling market purchases (rather than reducing them), with these purchases offset by an unprecedented (nearly sixfold) increase in market sales. NorthWestern is showing it will have a net reduction in PCCAM costs by selling nearly six times more energy into the regional market than it does today, an unprecedented increase that the utility does not justify in its filing. It’s unclear if the outdated and constrained transmission system could even move that much electricity annually. Of course, there is no penalty if NorthWestern fails to sell that much power into the market, in which case rates would skyrocket in a future quarterly PCCAM filing when customers don’t gain the fictitious benefit of a six-fold increase in NorthWestern’s market sales.

The Volatile Cost of Methane Gas

Unfortunately, NorthWestern’s greed doesn’t stop there. Having received PSC approval this July for a 33% rate increase to all gas customers, NorthWestern’s current request includes an additional 17% residential gas rate increase. That compounds to a 56% total increase in the same month! Compounded with last year’s 13% increase, that’s a 76% increase in residential gas rates that is before the PSC within a year. While the cost of expensive gas used to fuel the YCGS gas plant is technically factored into electricity rates, using more gas to fuel this plant could further strain an already volatile gas market.

A Blank Check for “Colstrip Compliance”?

NorthWestern claims it needs an increased share of the Colstrip plant because the plant provides reliable power. However, NorthWestern doesn’t bother to provide information in its application on why the Colstrip plant is necessary to ensure reliability on the power grid, other than a blind assertion that it is. This doesn’t even mention that claims of the plant’s reliability are greatly exaggerated (see article on pg. 6).

Even more concerning, buried within NorthWestern’s application is the request to create a “Reliability Compliance Balancing Account” for future “compliance costs necessary to continue to operate Colstrip.” In other words, NorthWestern is asking for customers to pay for long-overdue public health and environmental safeguards, so it can keep the Colstrip plant (the country’s dirtiest coal plant) open long after its useful life. The utility provides no details on how much money it will collect from customers, what it will buy with that money, or whether there are less expensive generation alternatives. This request asks for nothing less than a blank check from the PSC, charging customers an undisclosed fee on a per kilowatt-hour basis for any and all expenses incurred to bring the antiquated plant into compliance with national pollution standards.

NorthWestern conveniently left out that these compliance costs will likely exceed $2 billion, while some have estimated that this number could even exceed $3 billion. In 2018, the U.S. Department of Energy analyzed the cost of installing carbon capture and storage (CCS) at the Colstrip Power Plant and determined that it would cost over $1.3 billion to reduce only 63% of the CO2 emissions, decreasing the plant’s energy output in the process. Operating that carbon capture technology would cost an additional $108 million annually. In addition, if the Colstrip plant owners are to be believed, they have said that installing industry-standard pollution controls for toxic air pollution could cost customers in excess of $600 million. Every similar coal plant in the nation has already installed this technology. So, while NorthWestern seeks to nearly quadruple its ownership in the plant as the self-proclaimed only utility in the U.S. investing in more coal energy, it is asking for a blank check to pay for these upgrades – on top of the 26% increase – without considering the far less expensive alternatives to generate cleaner electricity.

What About Wind and Solar?

NorthWestern Energy operates as a monopoly utility in Montana, with the elected Public Service Commissioners serving as the last line of defense between the utility and Montana ratepayers. Unfortunately, the PSC has bowed to NorthWestern’s requests time and time again, leaving ratepayers defenseless. NorthWestern has now built the YCGS gas plant — the most expensive type of gas plant — and is trying to saddle customers with the expensive, unreliable, and decrepit Colstrip plant. Why? Because the utility makes a fixed rate of return on its capital investments, funded by ratepayers. The more money it spends, the more money it rakes in for its shareholders and executives’ multi-million dollar salaries. Without a PSC that demands protections for customers, it is no wonder that NorthWestern is making no further investments into wind and solar, the cheapest forms of energy available. While other states are stepping in to take advantage of Montana’s second-highest wind energy potential and fourth-highest solar energy potential in the nation, NorthWestern doubles down on the most expensive electricity-generating resources available, as reflected directly in our skyrocketing electric bills. MEIC is intervening in the rate case. Find information on our website: www.meic.org/rate-case

This article was published in the October 2024 issue of Down To Earth.