By Kyla Maki

In 2008, the annual average of natural gas prices was $8.18/million Btu. In 2011 the annual average was $4.05/million Btu. In the first few months of 2012 natural gas, has hit a new low at just over $2/million Btu. In just under four years, the wellhead price of natural gas has dropped by over half. The reason for such a rapid decline? The new glut of supply available because of horizontal drilling, coupled with hydraulic fracturing, or “fracking” technologies, has opened up shale gas areas to development well beyond what was possible only a decade ago.

The Bakken shale formation – stretching from Eastern Montana and into North Dakota – is currently the largest producing natural gas formation in the continental United States. According to conservative estimates, it will be producing for at least the next few decades.This glut in natural gas supply has rapidly decreased its costs. Low natural gas prices are having substantial impacts on future energy development decisions in the United States – both positive and negative. It is important to understand the benefits as well as the drawbacks of declining natural gas prices to understand its future influence on our clean energy future. Simply put, the current low natural gas prices are a double edged sword.

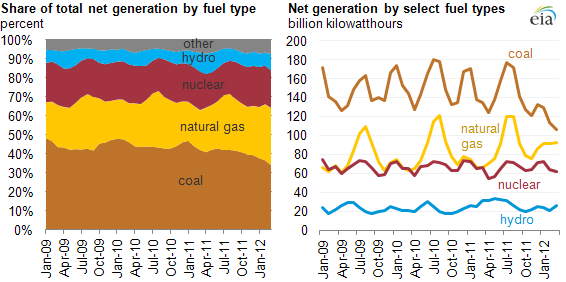

The most important benefit to lower natural gas prices are impacts on the price of domestic coal. According to the Energy Information Administration, Central Appalachian coal is just above the cost of natural gas (converting Btu to MMBtu). This shift in costs between the fuels has caused coal companies to displace their coal fired generation with natural gas facilities. In fact, coal went from providing at least 50% of the power generation in 2009 to providing only 34% today (See the graph below from the Energy Information Administration). Even the stock market is reflecting this dramatic shift. Arch Coal’s (primary promoters of developing Otter Creek) stocks have plummeted, from nearly $40 at the end of 2011 to just over $6. There are environmental and public health concerns associated with natural gas produced from fracking that cannot be ignored. However, natural gas has significantly less air pollution and global warming impacts than coal.

U.S. coal’s share of net generation continues to decline

One of the drawbacks of low natural gas prices are its impacts on the cost of renewable energy and energy efficiency. In many states in the Northwest, including Montana, the price that investor-owned utilities pay for renewable energy and energy efficiency is based on the cost of natural gas. As natural gas becomes cheaper, it competes with coal, but it also competes with clean and renewable energy resources because it drives down wholesale prices. The Northwest Power and Conservation Council, which helps to ensure that Montana, Oregon, Idaho, and Washington have affordable and reliable electricity, is now considering changes to the fuel price forecasts in their 6th Power Plan. Declining projections could cause wind and solar projects to become less lucrative and hamper their development.

Its important to remember that the only certain thing about natural gas is its uncertainty. Natural gas prices are extremely volatile– especially prices based on supplies from a technology whose environmental impacts are mostly unknown. Depressed natural gas prices provide much needed competition for coal, and make the case for other forms of clean energy displacing coal-fired power. It also highlights that the “lights won’t turn out” if we start transitioning away from dirty coal. Natural gas price volatility also proves that while its a better alternative to coal, we shouldn’t rely on it for the majority of our energy needs. Wind, solar and of course energy efficiency, are more sustainable and consistent resources to hang our hat on.

Bloomberg produced a list of the world’s highest and cheapest gas prices by country two weeks ago. The paper did not give a breakdown of the general components of oil pricing, where I believe oil taxes by governments comprise more than half of the oil retail prices in those countries, especially those in the top 10.