By Nick Fitzmaurice

In July 2024, NorthWestern Energy filed an application with the Montana Public Service Commission (PSC) to increase residential electricity base rates by 26%. This came on the heels of a decision by the PSC in October 2023 to approve a 28% increase to NorthWestern’s residential electric customers. The PSC now has until November 24, 2025 (subject to a possible 30-day extension) to make a final decision in NorthWestern’s current rate case.

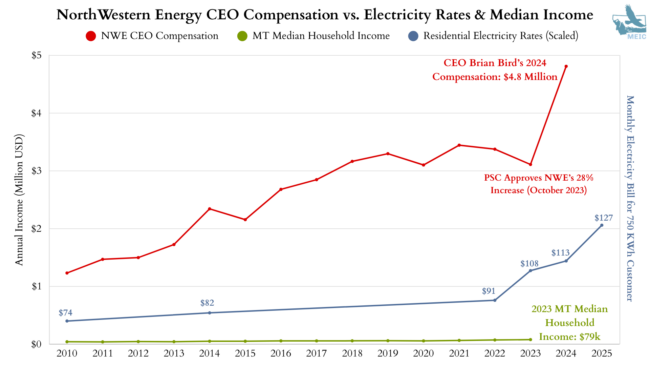

As electricity prices have skyrocketed over the last few years, so have NorthWestern’s executives’ compensation. CEO Brian Bird has seen the largest increase to his compensation, up 55% since 2023 to $4.8 million. NorthWestern’s rate increases are not the result of investments into reliable electricity. They are the result of a greedy monopoly utility taking as much as it can from cash-strapped Montanans and giving it to a CEO based in South Dakota. If the PSC approves another rate hike this fall, you can bet that NorthWestern’s executives will see another handsome bonus.

The chart below shows how compensation for NorthWestern’s CEO has increased dramatically over the years, from $1.2 million in 2010 to an outrageous $4.8 million in 2024. Over that same period, Montana’s median household income has increased only modestly, just barely keeping up with inflation. Overlaid on this chart are a handful of residential electricity bill snapshots from over the years, representing what a 750-kilowatt-hour (KWh) household would have paid for electricity in a given month. To represent these electricity data points on the same Million USD scale as the data for CEO compensation and Median household income, monthly rates are cubed. For example, cubing the monthly bill of $73.75 in 2010 scales the value to $0.401 billion. Cubing the monthly bill of $127.24 in 2025 scales the value to $2.060 billion.

Suffice it to say, Montanans cannot afford this steady stream of crippling electricity rate hikes and the CEO of the utility responsible for those hikes certainly doesn’t deserve to be rewarded for making Montanans electric bills unaffordable.

Data sources:

- Northwestern Energy’s CEO compensation values are pulled from the its annual Proxy Statements to shareholders.

- There are a number of estimates for Montana’s median household income. For consistency, data in this chart is pulled from the Federal Reserve Bank of St. Louis which provides a robust database of state-by-state median household income estimates over the years.

- Piecing together the price of electricity for NorthWestern Energy’s residential customers is a bit tricky as there is no central database tracking that information. Rates also vary throughout the year in response to fluctuating variable costs tied to fuel purchases (i.e. coal and gas to run power plants), sales and purchases of electricity on the market, and property tax adjustments, among other factors. This data is pulled from representative snapshots from over the years of what a 750 KWh residential customer of NorthWestern Energy might have paid for electricity in a given month.

Rates from 2010, 2014, and 2024 were derived from archived news articles, while other rates are pulled directly from NorthWestern’s filings at the PSC. Those articles represented the “typical residential customer” as using 800 KWh per month, while today NorthWestern represents the “typical customer” as using 750 KWh. Using the cost per KWh of electricity and NorthWestern’s Base Service Charge of about $4 per month, the bill for a 750 KWh customer was estimated.

In NorthWestern’s settlement filings from its 2022-2023 rate case, it produced a document showing that in August 2022 – prior to filing the rate case – the typical residential bill was $91.27. This same document shows that after the PSC approved NorthWestern’s interim rate increase request, the typical residential bill in March 2023 was $108.39. While the PSC eventually approved NorthWestern’s settlement in October 2023 for a 28% increase and a typical bill of $116.63, rate fluctuations (including a property tax reduction outside of NorthWestern’s control) reduced rates to $112.94 after the PSC signed its final order. These rates were in effect when NorthWestern filed its current rate case in July 2024.

There have been a number of rate fluctuations throughout the current rate case, with the PSC rejecting NorthWestern’s interim rate request in November 2024 to temporarily lower rates, NorthWestern self-implementing its own interim rates in May 2025 to $118.20, and NorthWestern increasing rates even more through its quarterly adjustment filing at the end of May. By NorthWestern’s own filing, rates on July 1, 2025, were slated to increase to $127.24. While NorthWestern shortly after backed off on its aggressive rate increase tactics, the utility has continued to hide the true bill impact of its proposed rate increase. It remains to be seen what NorthWestern’s residential electric customers will be paying when the PSC comes out with its final decision in the rate case this fall.