By Ian Lund

Electric vehicles (EVs) are coming, and Montana is getting ready. Thanks to the federal Infrastructure Investment and Jobs

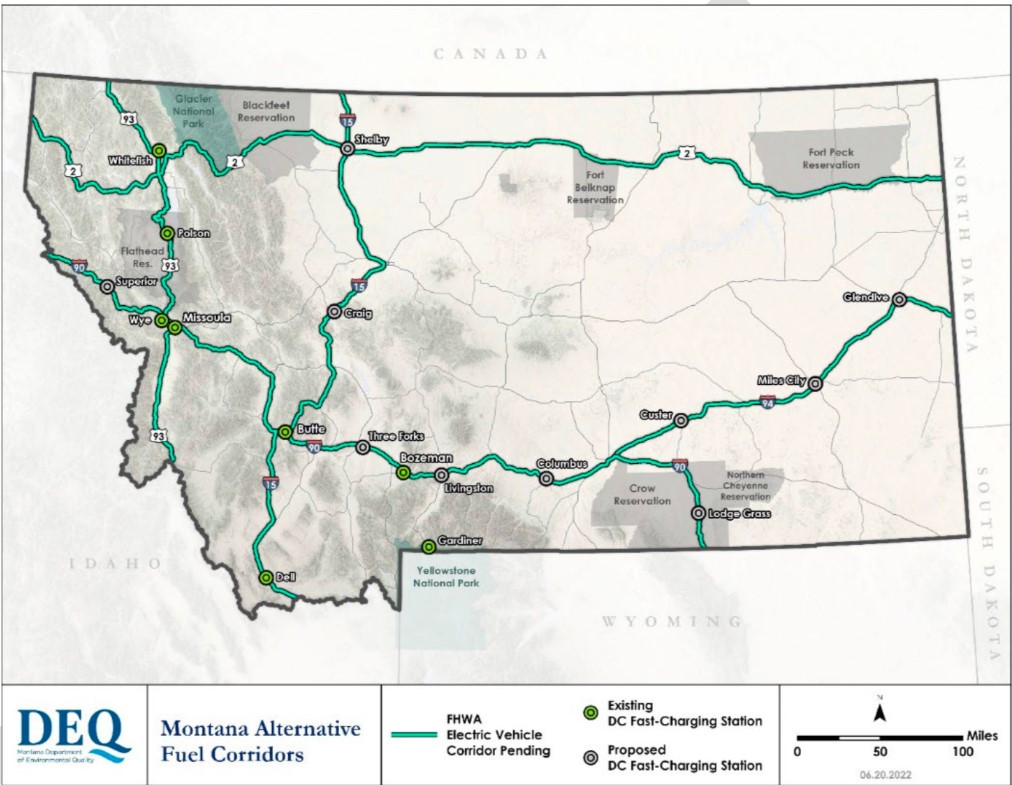

Act, which passed in 2021, Montana will receive almost $43 million over five years to develop an EV charging network across its highways. The funding is part of a national push to create a cross- country Alternative Fuel Corridor (AFC), to make long-distance EV travel possible. A fully built-out corridor consists of at least four fast EV chargers every 50 miles on major highways within one mile of the highway. This funding should help close the gaps between charging stations, especially in rural areas where there is a weaker business case for private investment.

According to its plan filed with the federal government in July, the State of Montana’s priorities for the AFC grant program are to fill large gaps of 100 miles or more along I-15, I-90, and I-94 in the first year; and then to fill 100-mile or greater gaps along US-2 and US-93, with a focus on gateway communities to national parks and recreation/tourism destinations, in the subsequent four years of funding.

Legislative Decision Making

On the policy side, the Legislative Transportation Interim Committee (TIC) is considering a bill that sets additional registration fees for EVs. The TIC proposed adding an $110 annual fee for EVs weighing less than 6,000 pounds, with escalating fees for heavier vehicles. Most light-duty EVs weigh in below 3 tons, meaning most EV drivers will only be subject to the $110 annual fee on top of existing registration fees.

Only 26 U.S. states have EV registration fees. They impose this tax on EVs as a way to replace the lost revenue from EVs not paying gas taxes. However, in reality, any registration fee greater than $110 is more than a comparable internal combustion engine vehicle would pay in gas tax, especially if that comparable vehicle is a highly efficient hybrid, which uses less

fuel. In 2021, the Montana Legislature tried to pass an additional annual registration fee for EVs of $195 for light duty vehicles and $375 for heavy trucks, which was vetoed by Gov. Greg Gianforte because it would have been the highest EV fee in the nation.

Lawmakers are also concerned that registration fees are not enough to cover lost revenue from out- of-state EV drivers who don’t pay a gas tax. A draft bill that would have established a $0.03/kWh tax on EV charging (in addition to the registration fee) died quickly in the July TIC meeting. This tax would be difficult to implement, redundant, and regressive. Because the registration fee covers the lost gas tax revenue, the EV charging tax would double-tax in- state EV drivers. Since most Montana EV drivers charge their vehicles at home, they will be less affected by the tax than tourists. However, Montana EV drivers that need to frequently use public charging could end up paying upwards of $100 in charging taxes, which, in addition to the registration fee, means EV drivers will pay twice as much in taxes as owners of internal combustion engine vehicles.

Luckily, TIC is reconsidering the wisdom of this tax, though still exploring other ways to tax out-of- state EV drivers. MEIC will keep you informed every step of the way.

This article was published in the September 2022 issue of Down To Earth.