![]() By Anne Hedges

By Anne Hedges

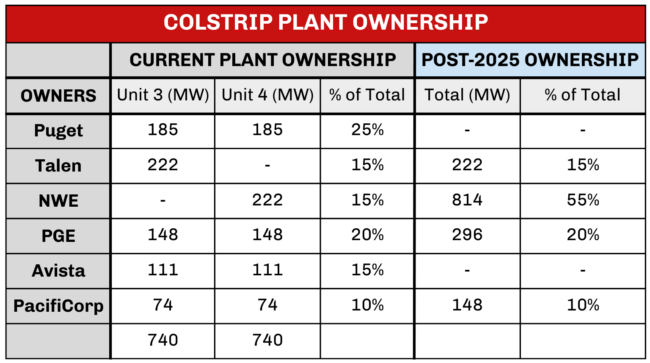

NorthWestern Energy is desperate for people to believe that our lights can only stay on if the utility owns more of the Colstrip plant. The Colstrip plant, a 1,500 megawatt coal-fired power plant, consists of two 40-year old units that are owned by six different companies (see graph). Each year, the plant is far and away Montana’s largest source of greenhouse gas pollution as well as many toxic air and water pollutants, including lead, arsenic, and cadmium. The problem is the plant is neither reliable nor affordable, yet NorthWestern wants to increase its share from 15% to 55%. Montanans simply can’t afford this high-risk investment in an unreliable plant.

In January 2023, NorthWestern announced its intent to double its share of the Colstrip plant by acquiring Avista Energy’s 15% share. In July 2024, months after a highly touted deal with Talen fell through, NorthWestern announced it had agreed to acquire Puget Sound Energy’s (Puget) 25% share. Both acquisitions will increase NorthWestern’s share of the plant from 222 megawatts to a whopping 814 megawatts – providing NorthWestern with far more power than its resource plans have projected needing for decades.

The True Cost of the “Free” Share of the Colstrip Plant

In 2021, Avista (which provides electricity to customers in Idaho and Washington) said the sooner it could exit the Colstrip plant, the more economical it would be. In the past, Puget tried twice to give its share of the plant to NorthWestern but both attempts failed. Puget then struck a deal with Talen, but Talen failed to follow through. So Puget returned to NorthWestern and struck a deal in July to give NorthWestern its unwanted share. It’s like a bad penny, but instead of our monopoly utility trying to avoid it, NorthWestern is adding to its coin collection.

NorthWestern touts that it is getting more of the plant for “free,” but this is one gift horse whose mouth you should inspect closely. The Colstrip plant is extremely expensive to own and operate, which is why most utilities are moving away from coal and trying desperately to exit the plant. As part of the deal made in 2008, NorthWestern’s customers continue to pay NorthWestern $407 million for its share in the plant plus a 10% premium that the Public Service Commission allowed NorthWestern to charge customers starting in 2008 – even though NorthWestern only paid $187 million for that share of the plant a year before.

Each year, budget-busting fuel and operating costs are passed on to captive customers. In 2023, NorthWestern’s customers paid $36 million for fuel for the plant. If NorthWestern’s share increases to 55%, customers will be on the hook for about $132 million in fuel costs each year. The current coal contract expires at the end of 2025, and costs are extremely likely to increase at that time.

Plant operating expenses are also significant. Non-fuel operating and maintenance costs were almost $79 million in 2023 (excluding Talen’s share). A 55% ownership share for NorthWestern means Montanans would be paying at least $52 million a year just for these non-fuel operating and maintenance costs.

In order to continue operating until “at least 2042,” as NorthWestern representatives have expressed, the plant will need to implement necessary — but long overdue and expensive — pollution control measures. While every similar coal plant in the nation already installed pollution controls for air toxics such as lead and arsenic, the Colstrip plant has not, resulting in it having the highest toxic emission rate of any other plant in the nation. NorthWestern estimates installing those controls now would cost somewhere between $350-600 million. Carbon pollution regulations require plants to reduce emissions by 2032 or the plants must close. A secret study by the Department of Energy in 2018 found that installation of carbon controls at the Colstrip plant would be $1.3 billion for a 63% reduction in carbon dioxide and would cost about $108 million a year to operate. Due to inflation and requirements to control more than 63% of the plant’s emissions, that cost will certainly be higher today. A 55% share of those costs would cripple the budgets of Montana families and small businesses. If NorthWestern wants to own more of the Colstrip plant, its shareholders should shoulder these costs, not hardworking Montana families who already face skyrocketing electricity bills.

There are many cheaper and less polluting ways or NorthWestern to provide customers with power. Currently there are more than 12,400 megawatts of proposed generation in Montana, nearly all of which are renewables and more than half of which have in-service dates before 2027. NorthWestern could replace the Colstrip plant with clean energy resources if it purchased less than 5% of the output of these projects.

Reliability Concerns

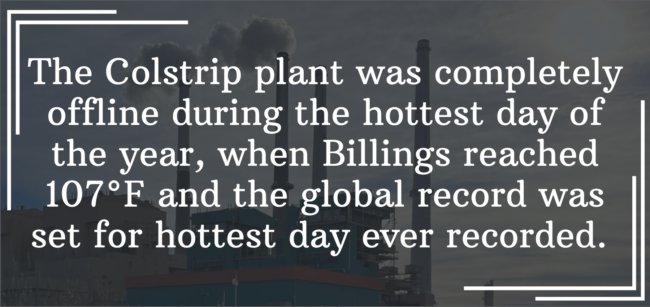

NorthWestern says that wind and solar aren’t reliable enough to provide power for its customers, but the reality is that the Colstrip plant is only 50% reliable when it is most needed. For example, as temperatures plummeted to record levels in early January, one of the two units at the plant had to be taken offline for “maintenance.” And during the July heat wave when temperatures across the state had been over 90°F for weeks, half the Colstrip plant went offline on July 18. A few days later, the entire plant went offline. The Colstrip plant was completely offline during the hottest day of the year, when Billings reached 107°F and the global record was set for hottest day ever recorded. NorthWestern never said why the entire plant was offline for almost a week in July. This “reliable” source of power is anything but.

Since 2023, as Puget Sound Energy planned to exit the Colstrip plant, it ramped up its purchase of Montana clean energy resources. Puget has signed long-term agreements for 665 megawatts of wind from two Montana wind farms and 40 megawatts of hydropower from Energy Keepers. In May, it announced it would add to these investments by building a 285-megawatt wind farm near Rapelje, Montana. While other utilities divest of the Colstrip plant and invest in Montana clean energy resources, NorthWestern invests in the past by acquiring more of an unreliable and expensive coal plant.

It’s time for some common sense, honesty, and transparency with a true goal of Montanans having access to reliable and affordable electricity. Montanans deserve at least that much if they have to foot the ever-increasing bills.

This article was published in the October 2024 issue of Down To Earth.