Cost of Energy in Montana:

Wind, Solar, and Hydroelectric vs. Fossil Fuels

Montana boasts the nation’s second highest potential for wind energy generation, and fourth highest potential for solar energy generation, according to a recent study by the National Renewable Energy Lab. In fact, Montana’s wind energy potential is the greatest across any state in the Western United States. While Montana’s monopoly utility NorthWestern Energy drags its feet on investing into these affordable clean energy resources, utilities from other states are already rushing to tap into this abundant energy source.

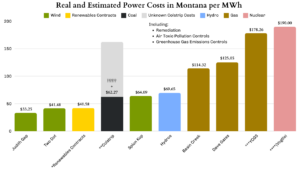

Carbon-free wind, solar, and hydroelectric energy have actually become the most affordable energy sources in our state. The graph below shows the cost per unit of energy (MWh) that NorthWestern Energy incurs from its different generation sources in the state, drawn from data that the utility shared with the Montana Public Service Commission (PSC) in 2023 and 2024. The nuclear power cost estimate for Vogtle is pulled from financial analyst firm Lazard’s annual Levelized Cost of Energy (LCOE) report.

*Required Qualifying Facility contracts under the federal Public Utility Regulatory Policies Act (PURPA). These plants are developed and run by independent energy developers, contracting power to NorthWestern Energy. As of this review, NorthWestern reported 11 wind plants, 14 hydroelectric plants, and 9 solar plants within this category. Two thermal plants: Colstrip Energy Limited Partnership (CELP) waste-coal plant and Yellowstone Energy Limited Partnership (YELP) petroleum coke plant are also included in this aggregate metric, driving up the average cost per MWh from these facilities.

**Not included in the cost per MWh of power from the Colstrip plant are future remediation costs that NorthWestern will be required to pay for upon the plant’s closure. These costs are unknown but NorthWestern will try to pass them on to ratepayers. While it is common practice for utilities to include these costs in rates throughout the useful life of a given plant, NorthWestern has elected to keep these costs separate to artificially reduce the cost of the plant’s power. Also not included in the cost per MWh of power from the Colstrip plant are long-overdue upgrades that NorthWestern must make at the plant to bring it into compliance with important environmental safeguards. NorthWestern has requested a blank check from the Public Service Commission to charge customers for these costs as they are incurred, but has not detailed what the costs will be. Finally, the Colstrip plant’s cost per MWh will almost certainly increase when the plant’s contract for coal fuel expires at the end of 2025. As the plant’s most accessible coal deposits from the neighboring Rosebud coal mine are exhausted, mine operators must continually mine further away, dig deeper, and work harder to supply fuel to the Colstrip plant. This, in turn, drives up the price of that coal. Already, the average price per ton of coal used for the plant increased by 43.5% between 2018 and 2023.

***While the Yellowstone County Generating Station methane plant near Laurel is projected to come online in late October 2024, this is the estimated cost per MWh for the plant’s operations based on the requested revenue requirement and projected annual fuel costs that NorthWestern has brought to the PSC.

****There is no nuclear power in Montana and, in fact, only one nuclear plant has been built in the United States in nearly 30 years. The two new units at the Vogtle nuclear plant in Georgia came online in 2023 and 2024. Vogtle was billions of dollars over budget and nearly a decade overdue as the most expensive power plant ever built. Until 2021, Montana had a citizen initiative in place that required a democratic vote of approval for any nuclear project in the state. However, the legislature overturned this requirement that had stood since 1978, and now NorthWestern Energy has expressed interest in including nuclear energy, the most expensive form of electricity, in its 20-year energy supply planning.

So, What is NorthWestern Energy Doing About It?

NorthWestern’s most recent clean energy investments – the small 40-megawatt (MW) Spion Kop and even smaller 11-MW Two Dot wind facilities – were built in 2012 and 2014, respectively (Two Dot sold power to NorthWestern until NorthWestern purchased it in 2018). The utility’s 20-year contract for power from the much larger (135-MW) and highly cost-effective Judith Gap wind farm expires in 2026, and NorthWestern has not planned for this power in its portfolio past that date. Today, most wind developers seek economies of scale by investing in facilities greater than 100 MW, with the largest wind project in the country rated at over 1,000 MW. However, NorthWestern appears to no longer have interest in wind energy development. All other wind projects in NorthWestern’s portfolio are required contracts under PURPA, and all of NorthWestern’s solar resources come from these required contracts. Despite NorthWestern’s claims, it has fought to keep these most affordable renewables out of its portfolio.

Montana’s hydroelectric dams have provided tremendous carbon-free electricity for over 100 years, but many argue that we have overpaid for these resources. Ratepayers funded Montana Power’s original construction of these assets, then again paid for these dams during the 15 years NorthWestern bought power from PPL as the utility paid off its debt in the assets. NorthWestern purchased these dams from PPL for nearly $900 million in 2014, so Montana customers are now paying off these assets a third time! While still an excellent form of carbon-free energy in the state, climate change is reducing hydropower’s output. NorthWestern’s hydropower output has decreased from 42% of its generation mix in 2019 to only 34% in 2023, while the utility’s continued investments into climate-damaging fossil fuel resources threaten to further reduce the productivity of these dams.

What are the Global Trends?

The International Renewable Energy Agency released a report in 2023 that included these key findings:

- In 2010, the global weighted average LCOE of onshore wind was 95% higher than the lowest fossil fuel-fired cost; in 2022, the global weighted average LCOE of new onshore wind projects was 52% lower than the cheapest fossil fuel-fired solutions.

- However, this improvement was surpassed by that of solar photovoltaics. This renewable power source was 710% more expensive than the cheapest fossil fuel-fired solution in 2010 but cost 29% less than the cheapest fossil fuel-fired solution in 2022.

The cost of fossil fuel energy remains stagnant, if not increasing, from rising fuel costs among other factors. This technology’s long existence means that any cost-saving innovations have already been realized and incorporated into new and existing generation plants. Meanwhile, renewable wind and solar energy are following tremendous learning curves, driving prices down as more of this energy is installed and the industry incorporates increased efficiencies and advances the technology. Wind developers, for example, have utilized increased turbine hub height, rotor diameter, and improved turbine technologies to increase energy output per turbine. In addition to generating more energy at less overall cost, larger turbines have made it possible to economically generate energy in areas with increasingly lower average wind speeds.

With wind and solar energy development still in their relatively nascent form, these sources already surpassed the generation from the Colstrip plant within NorthWestern’s portfolio in 2022.

Helpful Reports and Webpages

- Renewable NorthWest prepared a factsheet in 2021 on the potential for wind energy jobs in Montana.

- The US Energy Information Administration maintains this dashboard to track renewable electricity infrastructure facilities across the country.

- The US Department of Labor tracks clean energy jobs across the country that have been funded in part by the Inflation Reduction Act using this dashboard.

- Lazard’s Levelized Cost of Energy 2024 Report

- National Renewable Energy Lab report on wind and solar energy potential by state.

- Want to see where your electricity is coming from in real-time? NorthWestern Energy tracks its energy generation by source here, while the US Energy Information Administration maintains this dashboard that tracks electricity generation by source within NorthWestern’s balancing authority area.