Every two years, Montana’s largest private utility NorthWestern Energy is required to produce a Resource Procurement Plan—a blueprint for how to meet expected energy demand over the next 20 years. This plan helps guide the utility, as well as its regulators at the Public Service Commission and other stakeholders, on what to do when important decisions need to be made, such as what kind of power plants to build and when.

NorthWestern’s next Resource Procurement Plan is due in December 2018.

Sign the petition today asking NorthWestern to protect its customers from coal risks and to invest in clean energy!

The 2018 Resource Procurement Plan

In the 2018 plan, NorthWestern needs to prepare for the closure of Colstrip by 2027 or earlier.

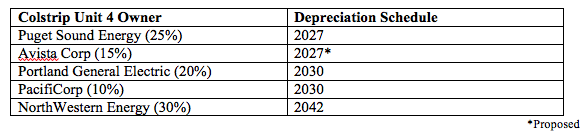

NorthWestern owns a 30% share of Colstrip Unit 4. Currently, every other owner of Unit 4 has either agreed, proposed, or is required by law to pay off their outstanding Colstrip debt (aka “depreciate”) by 2027 or 2030, meaning they will be financially ready to close the plant by that time. In contrast, NorthWestern’s depreciation schedule is 2042. If Colstrip closes before NorthWestern has paid off its share of the plant, customers will be stuck paying for a power plant that is not producing electricity. This makes it extremely important that as NorthWestern plans for the future, it protect its customers by depreciating its outstanding Colstrip debt by 2027.

Therefore, in the 2018 Resource Procurement Plan, NorthWestern should prepare for this eventuality by modeling a scenario in which Colstrip closes by 2027.

What Should NorthWestern Do?

In the 2018 plan – and in future regulatory processes like the coming electric rate case – NorthWestern needs to protect its customers by preparing for Colstrip’s closure, including:

- Modeling a 2027 closure date for Colstrip in the 2018 resource plan.

- Planning to meet future energy needs with clean, renewable energy and energy efficiency.

- Depreciating NorthWestern’s ownership of Colstrip by 2027 to protect customers just as other Colstrip owners have done.

- Set aside money to clean up polluted groundwater and help community transition in Colstrip just as other Colstrip owners have done.

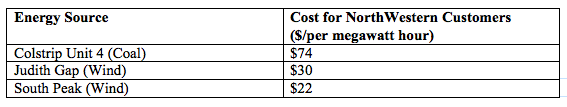

Renewable Energy is Extremely Cost Competitive for NorthWestern Customers

Renewable energy such as wind and solar are the cheapest, cleanest, and least-risk generation options for the utility to meet its future electricity demand. In fact, the South Peak and Judith Gap wind facilities are the two cheapest power plants for NorthWestern customers. In contrast, coal-fired electricity from Colstrip is one of the most expensive sources of electricity for NorthWestern customers.