For the first time ever, NorthWestern Energy is hosting a public meeting regarding its long-term resource plan. This important plan helps guide the utility when deciding where to get its energy from over the next 20 years. We need you to attend and tell NorthWestern you want more clean energy – not fossil fuels!

WHEN: April 18th from 9 am – Noon

WHERE: NorthWestern Energy Butte Headquarters, 11 E. Park St., Butte, MT

WHO: You! Join MEIC members and allies from across the state for this important event

Questions? Contact MEIC’s Brian Fadie at 406-443-2520 or bfadie@meic.org

If you cannot attend but would like your voice to be heard, please click here to sign a petition.

Below is background information about the April 18th event. Click here to download a printable PDF of this information to bring with you on the 18th.

What is a Resource Procurement Plan?

Every two years, Montana’s largest private utility NorthWestern Energy is required to produce a Resource Procurement Plan—a blueprint for how to meet expected energy demand over the next 20 years. This plan helps guide the utility, as well as its regulators at the Public Service Commission and other stakeholders, on what to do when important decisions need to be made, such as what kind of power plants to build and when.

NorthWestern’s next Resource Procurement Plan is due by December 2018. The meeting on April 18th is part of the creation of this plan.

The 2018 Resource Procurement Plan

In the 2018 plan, NorthWestern needs to prepare for the closure of Colstrip by 2027 or earlier.

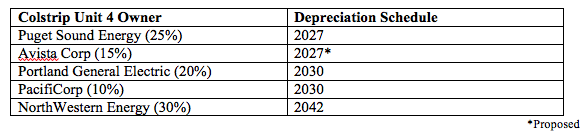

NorthWestern owns a 30% share of Colstrip Unit 4. Currently, every other owner of Unit 4 has either agreed, proposed, or is required by law to pay off their outstanding Colstrip debt (aka “depreciate”) by 2027 or 2030, meaning they will be financially ready to close the plant by that time. In contrast, NorthWestern’s depreciation schedule is 2042. If Colstrip closes before NorthWestern has paid off its share of the plant, customers will be stuck paying for a power plant that is not producing electricity. This makes it extremely important that as NorthWestern plans for the future, it protect its customers by depreciating its outstanding Colstrip debt by 2027.

Therefore, in the 2018 Resource Procurement Plan, NorthWestern should prepare for this eventuality by modeling a scenario in which Colstrip closes by 2027.

What Should NorthWestern Do?

In the 2018 plan – and in future regulatory processes like the coming electric rate case – NorthWestern needs to protect its customers by preparing for Colstrip’s closure, including:

- Modeling a 2027 closure date for Colstrip in the 2018 resource plan.

- Planning to meet future energy needs with clean, renewable energy and energy efficiency.

- Depreciating NorthWestern’s ownership of Colstrip by 2027 to protect customers just as other Colstrip owners have done.

- Set aside money to clean up polluted groundwater and help community transition in Colstrip just as other Colstrip owners have done.

Renewable Energy is Extremely Cost Competitive for NorthWestern Customers

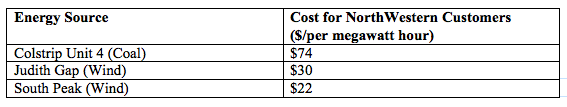

Renewable energy such as wind and solar are the cheapest, cleanest, and least-risk generation options for the utility to meet its future electricity demand. In fact, the South Peak and Judith Gap wind facilities are the two cheapest power plants for NorthWestern customers. In contrast, coal-fired electricity from Colstrip is one of the most expensive sources of electricity for NorthWestern customers.

Options for Adding Renewable Energy Without New Fossil Fuels

An issue likely to be addressed at NorthWestern’s April 18th public meeting is the “integration” of renewable energy. Because the output of wind and solar facilities can increase or decrease throughout the day, other sources of electricity must be available to increase or decrease as well to keep the grid in balance. There are many ways to provide this integration service without committing utility customers to paying for expensive and risky new fossil fuel power plants. Other utilities across the country have successfully integrated high levels of renewable energy; NorthWestern should do so as well by:

- Efficiently using existing NorthWestern power plants to integrate renewables

- Contracting with existing integration power plants in the region

- Investigating pumped hydroelectric energy storage facilities

- Investigating battery energy storage technologies

- Improving weather and energy output forecasting tools

- Pursuing geographic diversity among renewable energy facilities

- Deploying advanced inverter technologies

- Investigating operation strategies for renewable energy facilities that reduce integration

- Demand Side Management programs

- Investigating entry into a regional energy market

Newly Available Revenue from Reduced Utility Taxes Should Help Colstrip

The passage of the federal tax cut legislation in December 2017 reduced NorthWestern’s tax rates, however revenue had already been collected to pay the old, higher tax rates. For NorthWestern, this has created a fund of about $14 million that is now available for other purposes.

NorthWestern should put this unexpected and unallocated revenue toward a Colstrip community transition fund, cleaning up the polluted groundwater around the town, and mitigating any ratepayer impacts due to an accelerated depreciation schedule for Unit 4. Other Colstrip co-owners have already set aside funds for community transition. As the home state utility, NorthWestern has an obligation to help with Colstrip’s transition as well.